Foundational Principles of Wealth: The Wealth Pyramid, Building on a Solid Foundation

The Wealth Pyramid: Building on a Solid Foundation

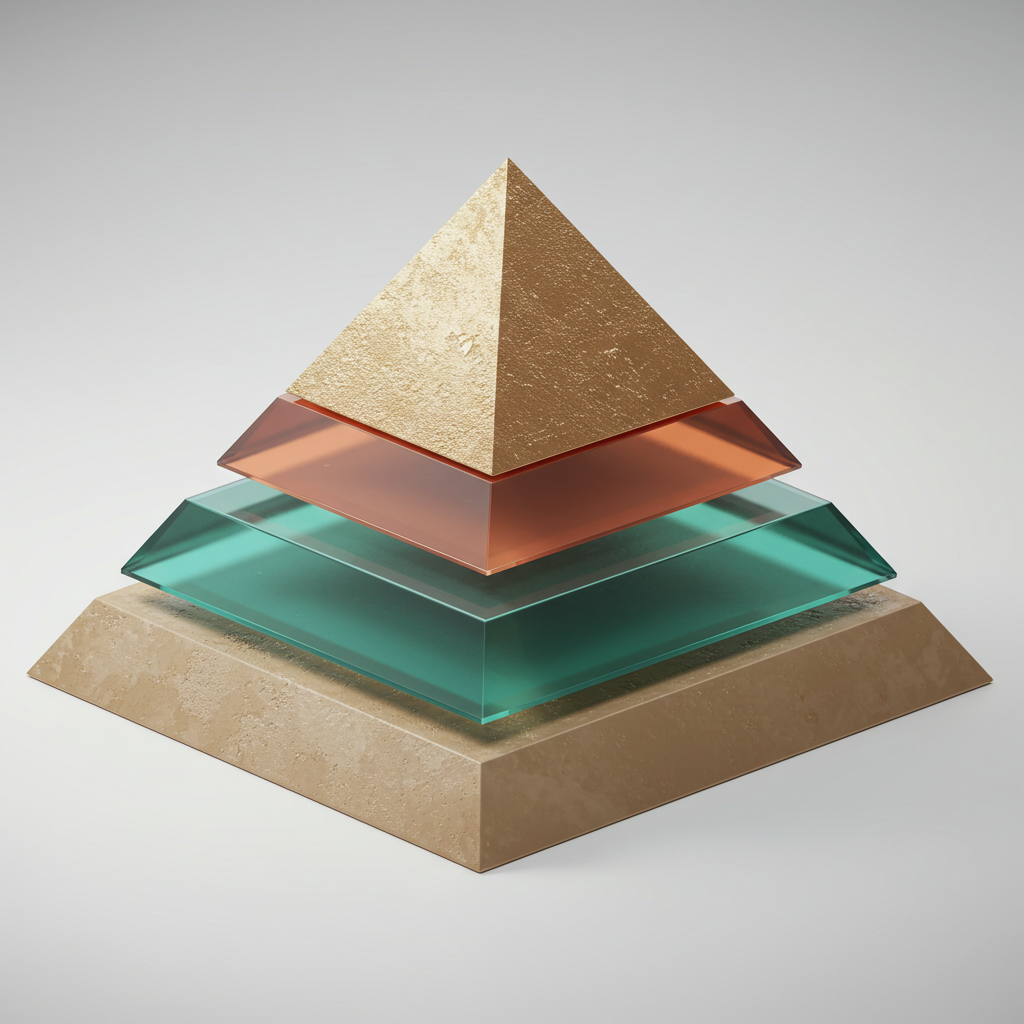

When it comes to building substantial, generational wealth, skipping the foundational steps can cause your entire financial plan to crumble. Just like constructing a pyramid, wealth-building requires a strong and stable base before you can move toward the peak—legacy and abundance. This article will walk you through the Wealth Pyramid, a practical framework to help high-income earners like you optimize cash flow, use strategic debt, minimize taxes, and intentionally build wealth for future generations.

Let’s start at the bottom and work our way to the top.

Step 1: The Wealth Pyramid Framework

Think of your wealth-building journey as a pyramid with four layers:

Stability: Optimizing income, protecting assets, and creating financial safety nets.

Growth: Deploying capital into income-generating investments.

Abundance: Scaling wealth through advanced strategies, systems, and diversification.

Legacy: Preserving and passing on wealth across generations.

Why Skipping Steps Hurts Your Wealth

Too often, people jump straight to investing or legacy planning without ensuring their foundation is solid. If you don’t have optimized cash flow, risk management, and tax strategies in place, unexpected expenses or market downturns can send your wealth-building efforts spiraling. A solid foundation gives you the confidence to take calculated risks and seize opportunities.

Step 2: Optimizing Cash Flow – Making Your Money Work for You

Cash flow is the fuel for your wealth-building engine. High earners often assume they’re doing well because they bring in significant income, but inefficient cash flow management can leave a lot of money on the table.

Key Strategies:

Identify High-Value vs. Low-Value Expenses: Prioritize spending that adds value to your life or builds wealth. Cut out inefficiencies like unused subscriptions or overpaying for services.

Adopt a Modified 30/20/40/10 Rule: For wealth-focused individuals:

30% to needs

20% to wants

40% toward savings reserve and investments that grow your wealth

10% to charitable causes that resonate with you and make an impact in the world

Increase Cash Flow:

Negotiate raises or bonuses

Explore side income (equity, dividends, or small business ventures)

Optimize taxes and reduce high-interest debt

The goal? Every dollar should have a job, and its job should be to build wealth.

Step 3: Strategic Debt – Using Leverage to Build Wealth

Debt often gets a bad reputation, but for savvy wealth builders, it can be a powerful tool. The key is knowing the difference between good debt and bad debt.

Bad Debt: High-interest consumer debt (credit cards, personal loans) that does not create value.

Good Debt: Low-interest debt used to acquire assets that generate income or appreciate, such as:

Real estate investments

Business loans to scale a company

Leveraged investments (done carefully)

Key Strategies for Managing Debt:

Eliminate high-interest debt first (e.g., credit cards).

Use the after tax net cost when considering what debt to pay off

Use low-cost debt to acquire income-generating assets like rental properties or businesses.

Avoid lifestyle inflation—don’t let higher earnings lead to unnecessary debt.

Debt, when managed strategically, can amplify your wealth-building efforts without holding you back.

Step 4: Mastering Tax Efficiency – Keeping More of What You Earn

For high-income earners, taxes can quietly become the largest expense in your life. Fortunately, you can optimize your tax strategy to keep more of what you earn and put it to work.

Strategies for Tax Optimization:

Max Out Tax-Advantaged Accounts: Contribute to IRAs, 401(k)s, and HSAs to lower taxable income.

Plan for Capital Gains: Always consider tax implications when making investment decisions, holding longer may make more sense due to long term capital gains

Take Advantage of Real Estate Tax Benefits:

Depreciation write-offs

1031 exchanges to defer capital gains

Explore Niche Tax Benefits:

Oil and gas investments for unique deductions

Syndicated investments that combine tax efficiency and ROI

Leverage Business Structures: LLCs, S-Corps, and partnerships can reduce personal tax liability.

A well-thought-out tax strategy can compound your wealth dramatically over time.

Step 5: Protecting Wealth – Risk Management and Insurance

Protecting your wealth is just as important as growing it. Without the right protections, lawsuits, health emergencies, or market crashes could set you back.

Key Risk Management Tools:

Asset Protection Strategies: Use legal structures like trusts or LLCs to safeguard assets.

Insurance:

Life insurance to secure your family’s future

Disability insurance to protect your earned income while it’s a factor

Umbrella policies for additional liability protection

Estate Planning: Create wills and trusts to minimize estate taxes and ensure your wealth is passed on according to your wishes.

Diversification: Balance risk by diversifying investments across:

Stocks

Real estate

Alternative investments

Risk management ensures the wealth you build stays protected for the long haul.

Step 6: Turning Savings into Investments – Deploying Capital Strategically

High-income earners often accumulate cash without a clear plan to deploy it. Saving alone won’t build wealth; you need to invest excess capital into assets that generate income and appreciate.

Investment Opportunities:

Stocks: Research and decide what works best for you. There are benefits in each category, and more options than you can realistically utilize. Growth, value, small cap, and stable stocks, ETFs, dividend stocks, private equity, REITs, etc etc.

Real Estate: Single-family rentals, multi-family properties, or syndicated real estate deals.

Over time it is imperative that you shift towards the highest quality income producing real estate. Lower class (C, D) investments require very large resource input and are more like owning a job than owning an investment, and are not great for passing to the next generation. Typically you want homeowner grade investment properties in your portfolio when you pass.

Businesses: Acquire or invest in income-generating businesses or franchises.

Partnership: Invest in the company you work for as a partner, if you believe in the company and want to stick around for the long term.

Alternative Investments: Life insurance cash value, precious metals, private lending, or oil and gas.

Your goal is to create a balanced, passive-income-focused portfolio that allows your money to work harder than you do.

Step 7: Automating Wealth – Systems for Growth Without Effort

As a high earner, your time is precious. Automating your finances ensures progress without requiring constant effort.

Key Systems to Implement:

Automate savings and investment contributions.

Schedule debt payments to eliminate high-interest liabilities.

Use financial dashboards to track net worth, cash flow, and progress toward goals.

Work with financial advisors, tax strategists, and investment managers—but understand the strategies yourself so you stay in control.

Automation creates momentum and eliminates decision fatigue.

Step 8: Building Legacy – Laying the Foundation for Generational Wealth

Generational wealth doesn’t happen by accident; it requires intentional planning.

Key Steps to Build Legacy:

Define Your Vision: What does generational wealth mean to you?

Legacy Planning Basics:

Set up family trusts to protect and transfer wealth efficiently.

Educate heirs on financial principles and wealth stewardship.

Pass on income-generating assets like real estate, businesses, or investments.

Protect Wealth Across Generations: Use tools like life insurance, estate planning, and tax strategies to ensure your wealth endures.

Creating a legacy isn’t just about money—it’s about building a future that lasts for generations.

Conclusion: Your Foundation for Lasting Wealth

Building generational wealth starts with a solid foundation. By focusing on cash flow optimization, strategic debt, tax efficiency, risk management, and intentional investing, you’ll create a stable base that can support long-term growth and a lasting legacy.

The Wealth Pyramid is your blueprint—take one step at a time, and soon you’ll be at the peak, looking back at the solid foundation you built.

Ready to take action? Start by assessing where you are in the pyramid today—then move upward, one layer at a time.